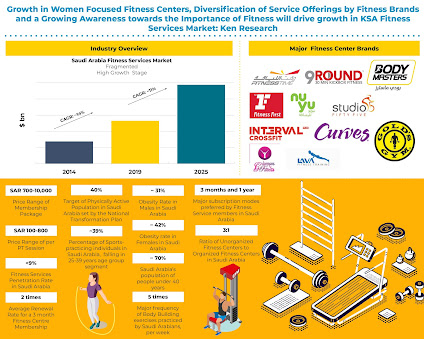

There are close to 28+ organized fitness center brands functioning in the Kingdom along with unorganized fitness centers. While the complete industry has been recognized at a high growth stage, the competition in the industry is observed to be fragmented in nature, in terms of number of players. A high degree of fitness centers in the Kingdom are unorganized and independent, while the occurrence of organized fitness center brands is limited to foremost cities such as Riyadh, Jeddah, Dammam, Al Khobar, Makkah and Medinah. Players compete on the basis of Price, Membership Offers, Center Facilities, Personal Training, Ambience, Services Offered and Locations.

According

to the report analysis, ‘Saudi

Arabia Fitness Services Market Outlook to 2025- By Market Structure (Organized

and Unorganized), By Revenue Stream (Membership, Personal Trainer and

Supplementary Services), By Regions (Riyadh, Jeddah, Dammam, Al Khobar, Makkah

and Madinah and others), By Subscription (3 months, 6 months, 1 year and

others), By Gender (Male and Female), By Age (Below 18 years, 19 to 30 years,

31 to 60 years and above 60 years) and By Income Group (Below SAR 38,000, SAR

38,000 to SAR 94,000, SAR 94,000 to SAR 150,000 and above SAR 150,000)’

states that KSA is an emerging country in terms of industry competition,

making it a fierce battlefield for new and prevailing fitness-center brands

trying to operate/prosper and to make profits. Foremost existing fitness center

players hold brand loyalty particularly among professionals, owing to safety

concerns linked with using fitness equipment. This makes it problematic for new

players to enter the market. Establishing a great fitness center that provides

all services comprising spa, pool, steam bath, lockers, showers, Jacuzzi along

with gym services has also prevented companies from mounting their businesses

over a certain geographic limit. The three aspects that mainly underwrite to

the high cost of establishing a fitness center have been the cost of receiving

land, cost of hiring trained and certified fitness professionals and cost of

purchasing the gym equipment. This has been disheartening new players with low

capital from entering the market. A gradual customer shift towards brand

acceptance and new requirement for female specific fitness centers has

motivated service providers to explore and probably convert this requirement in

their favor.

Female

Gym Fitness Market Saudi Arabia

There

has been a remarked aim on enhancing the women centers in the Kingdom, spurred

by the favorable judgment from the General Authority of Sports. Several fitness

players are now aiming a large part of their future strategies on capitalizing

on the augmenting Female Fitness segment, by opening female gyms. As part of

the Vision 2030 plans, the Saudi Government launched the National Transformation

Plan, which aims on encouraging the health and wellness among people in the

country and enhancing the number of physically active individuals in the

Kingdom, from 13% to 40% by 2030. There has been an aim on specialized and

concept fitness centers, with Crossfit, Kickboxing, HIIT and Zumba leading the

exercises in requirement by fitness center members in the country. A heavy

spread of awareness among the generally physically unfit Saudi population, is

resulting in high requirement for fitness services, particularly by individuals

from the age of 20 years to 45 years.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MzM2NTQ3

A

special aim must be laid on penetration of the relatively nascent women fitness

segment in the industry in Saudi Arabia. Presence of customized workouts, with

growth in implementation for personal training programs is projected to come

into effect in a few years from now. Provision of value-added services such as

free membership freezing, couple discounts, locker room facility, free showers,

sauna, spa will eventually aid fitness brands to target a broader chunk of the

customer segments and augment the fitness services penetration rate in the

country. Development plans of many fitness centers will be put on control, for

a while as the Covid situation hits the short-term and long-term business

sustainability for gyms in the Kingdom. In future, the Saudi Arabia Fitness

Services Industry is projected to augment at a CAGR of ~10.7% during the

duration 2019-2025.

Related Reports

Follow Us

LinkedIn | Instagram | Facebook | Twitter | YouTube

Contact Us:-

Ken

Research

Ankur

Gupta, Head Marketing & Communications

+91-9015378249