The report titled “Philippines Remittance and Payments Market Outlook to 2024 – Growth Backed by Sustained Internal Migration, Rise in Overseas Filipino Workers and Surge in BPO Sector” provides a comprehensive analysis of domestic, international remittance and bill payments market in the Philippines. The report covers market size, segmentation on the basis of remittance flow corridors, remittance channel, land-based and sea-based workers, mode of remittance, major occupation group and distribution of OFWs by cash remittance sent for international remittance market. For domestic remittance market, the report covers market size, segmentation on the basis of remittance channel, type of services and major flow corridors. It also includes the bill payments market in the country covering the market size and segmentation by type of bills, mode of payments and channel of payments. The report also covers government regulations in the market, competitive landscape and company profiles for major players in the remittance and bill payments market. The report provides a detailed overview of future outlook & projections with analyst recommendations for the industry.

The report facilitates the readers with an in-depth analysis of the existing and future trends, issues, and challenges prevalent in the industry and anticipated growth in the future depending upon changing industry dynamics in coming years. The report is useful for industry consultants, remittance service providers (MTOs), banks, local agents, payment platforms, pawnshops, and other stakeholders to align their market-centric strategies according to ongoing and expected trends in the future.

Industry Overview

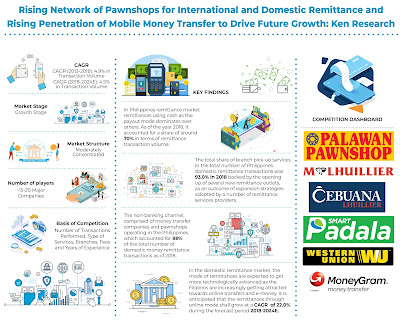

The Philippines the remittance market is led by international remittances and domestic remittances which are represented by the OFW remittance inflow, the internal migrant’s transfers. During 2013-2018, the international and domestic remittance markets have showcased a remarkable growth. The Overseas Filipino Workers (OFWs) space has been the most important source of growth in the Philippines economy. The majority of the OFWs primarily originate from the Cavite, Laguna, Batangas, Rizal, and Quezon (CALABARZON) region, and the peripheral regions of Central Luzon and Metro Manila. Market growth can be attributed to factors like an increasing number of OFWs, growing infrastructure and developmental activities, rising business sectors and increasing job opportunities within the country, surging BPO sector and other related factors.

International Remittance Market

Market Potential: The Philippines international remittance market registered a majority contribution from inbound remittances from other countries in 2018. Stable progress in the diversity and coverage of global remittance, networks have enabled more OFWs to remit money at a reasonable cost of services which include automated teller machines, web-based services, and reusable/reloadable cash cards.

By Countries: The US accounted for the majority of the total remittances sent to The Philippines in 2018. Saudi Arabia was ranked as the second largest remittance source for the Philippines. UAE accounted for a major share of the remittance to the Philippines in 2018 and is one of the biggest employers of OFWs.

Competitive Landscape in the International Remittance Market

The continued expansion of remittances in the past several years has been impelled by the sustained innovation on the part of banks, money transfer companies and other financial institutions which provide remittance services to overseas Filipino workers. Majority of the money remittances received by Filipino households are routed through commercial banks. In 2018, more than 80% of the total remittances were coursed through banks, indicating Filipinos’ mounting faith on this channel instead of sending money back home by means of friends or relatives. Remittances transferred through banks have showcased inclining participation over the last five years. Banco de Oro was the largest bank in the Philippines remittance market in 2018 in terms of transaction volume coursed through banks. BDO has formed several partnerships with other money transfer companies and pawnshops in the past few years. This has significantly helped the bank to register a strong performance in the international remittance space.

Domestic Remittance and Bill Payments Market

Market Overview: The market for domestic money transfers in the Philippines is exceedingly dynamic and has been maturing since the past decade. The choice of the service provider, to a greater degree, has been dependent upon the amount of money being transferred. Bank transfers and major PSPs were mostly used in order to transfer large amounts of money.

Domestic Remittance Flow Corridors: In-country Filipinos, characterized by domestic migrants who have moved for better economic and employment opportunities and permanent residents together, accounted for a major share of the total domestic remittances. Additionally, the majority of the overall domestic remittances was funded by people/families who have also received international remittances from Filipinos in other countries. Domestic remittances were observed to be transferred in top cities amongst the provinces included Quezon City, Manila, Makati, Caloocan, Paranaque, Pasig, Mandaluyong, Taguig, Pasay, and Baguio.

Sources of Bill Payment: Convenience stores such as 7-Eleven and Ministop are the major third-party payment channels of the total bill payments in the Philippines in 2018. Owing to the greater reach and accessibility; convenience stores have dominated the bill payment landscape in the Philippines over the past many years. Bill payments through mobile and online platforms have displayed a tremendous growth over the past five years with growing mobile wallet and the number of online methods offered by banks and other local players. Conversely, informal service providers were largely used in semi-urban and rural areas.

Competitive Landscape in Domestic Remittance Market

The domestic remittance market is dominated by pawnshops and MTO due to the large unbanked or under-banked population in the Philippines. The enormous potential of domestic remittances has also engrossed international players such as Western Union into the market. Conversely, the Philippines-based service providers such as banks, regional and national pawnshops including Smart Padala, Cebuana and M Lhuillier and Palawan Pawnshops, LBC Express and others have a noteworthy presence in the domestic market and have provided stiff competition to the international players. Banco de Oro was the largest bank in the Philippines international remittance market in 2018 followed by The Bank of Philippine Islands while Metropolitan Bank was the third largest international remittance player in 2018.

Future Potential

The Philippines remittance and bill payments market has witnessed considerable growth in the past five years. A noticeable amount of FDI inflows was invested in BPO, electronics, and energy sector. With the continual growth in FDI flows in the BPO sector, more employment opportunities are expected that will lead to large scale migrations to urban cities. Rapid growth in the introduction and use mobile technologies in the country for money transfer and bill payments are also a factor for the future growth of domestic remittance and bill payments market of the Philippines.

The continued growth in internal migration is expected to sustain the growth of money transfers taking place in the Philippines. The Philippines has outshined India in terms of voice-based outsourced projects and has become the worldwide leader in the call center industry. Over the past six years, the BPO industry in the country has augmented at an average rate of 25%-30%. International remittance market in the Philippines will continue to be driven by the increasing deployment of Filipinos in other countries. Unskilled workers and laborers will uphold their status as the largest deployed fraction of overseas workers and will continue to account for the largest share of aggregate remittances.

Key Segments Covered:-

Domestic Remittance

By Remittance Channels

Banks

Non Banks

By Types of Services

Branch Pick-Up

Online

Door to Door

Prepaid Cards

Direct Credit to Bank Account

By Major Flow Corridors

Bill Payment Market

By Channel of Payment

Banks

Non Banks

By Type of Payments

Water

Electricity and Fuel Bills

Insurance Premium

Communication

Education

By Mode of Payment

Offline

Online

Method of Payment

Convenience Stores

Online/Mobile Payments

Biller’s Business Offices

Remittance Companies

Banks and Others Offline

International Remittance Market

By Major Flow Corridors

US

UAE

KSA

UK

By Remittance Channels

Banks

Non Banks

By Payout Mode

Cash

Non-Cash/Electronic Transfer

Door to Door Delivery Method of Payment

Key Target Audience:-

Money Transfer Operators

Banks

Pawnshops

Bill Payment Companies

M-Wallets

Mobile Money Companies

Central Bank

Investors and PE Firms

Convenience Stores

Time Period Captured in the Report:-

Historical Period – 2013-2018

Forecast Period – 2019-2024

Companies Covered:-

International Remittance Companies:

Banco de Oro

The Bank of Philippine Islands

Metropolitan Bank

Cebuana Lhuillier

M Lhuillier

Palawan Pawnshop

Western Union

LBC

iRemit

Wells Fargo

Xoom

Domestic Remittance Companies:

Palawan Pawnshop

Cebuana Lhuillier

Smart Padala

M Lhuillier

LBC Express

BDO

BPI

Western Union

Key Topics Covered in the Report:-

An ecosystem of Philippines Remittance Market

Overview of Philippines Domestic Remittance Market

Philippines Domestic Remittance Market Size

Philippines Domestic Remittance Market Segmentation

Growth Drivers of Philippines Domestic Remittance Market

Competitive Landscape of Major Players in Philippines Domestic and International Remittance Market

Philippines Bill Payments Market Size

Philippines Bill Payments Market Segmentation

Rising Penetration of Mobile Money Transfers

Philippines Domestic Remittance and Bill Payments Market Future Outlook

Philippines International Remittance Market Overview

Philippines International Remittance Market Size

Philippines International Remittance Market Segmentation

Trends in the Philippines International Remittance Market

Philippines International Remittance Market Future Outlook

Macroeconomic Factors affecting Philippines Remittance and Bill Payments Market

Complete Report is Available Here:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249